By Henry Stewart

The 2018 State of the Canadian Space Sector, the latest in a series of annual compilations of Canada's space capabilities produced by the economic analysis and research team at the Canadian Space Agency (CSA), is now online. Although it was released on Thursday April 4th, 2019, it's officially a 2018 report using data collected in 2017.

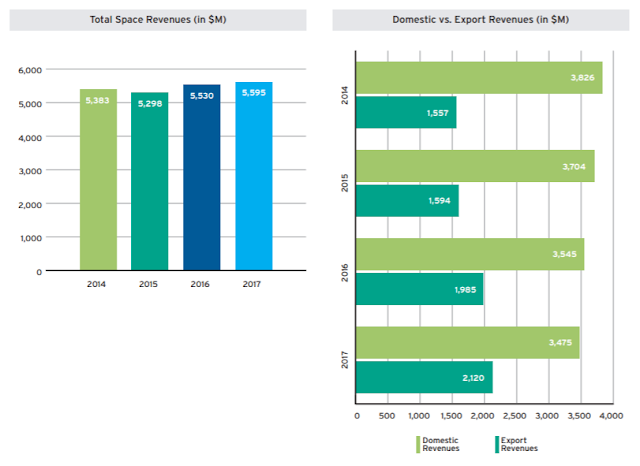

The latest report continues to note a long-term pattern of declining domestic sales of Canadian space focused products while international sales of the sames products increase.

As outlined in the executive summary of the report:

Recent State of the Canadian Space Sector Reports, as outlined in the December 4th, 2017 post, "The Latest CDN Space Sector Report Notes 5 Year Slump (Except for BC) & Industry Dominates, Not Academia or Gov't," and the July 26th, 2018 post, "Assessing the 2016 State of the Canadian Space Sector Report" have noted an ongoing stagnation of Canadian space industry activities with declining domestic revenues offsetting the growth in sales from international markets.

The latest report continues this trend, although overall growth is now positive. It's likely that the Canadian space industry has finally pulled out of the long-term slump first noted in the 2016 report.

With Ottawa ON based Telesat moving forward with its low-Earth orbit communications constellation and new Federal funding expected to begin flowing to fund Canada's multi-billion dollar "3rd generation Canadarm" contribution to the US led Lunar Gateway beginning next year, it's likely that domestic sales revenue will now begin to increase in parallel with the international market.

The 2018 State of the Canadian Space Sector, the latest in a series of annual compilations of Canada's space capabilities produced by the economic analysis and research team at the Canadian Space Agency (CSA), is now online. Although it was released on Thursday April 4th, 2019, it's officially a 2018 report using data collected in 2017.

The latest report continues to note a long-term pattern of declining domestic sales of Canadian space focused products while international sales of the sames products increase.

|

| The front cover of the PDF version of the 2018 State of the Canadian Space Sector Report. Graphic c/o CSA. |

As outlined in the executive summary of the report:

- In 2017, the space sector contributed $2.3Bln CDN to Canada's GDP and supported a total of 21,828 jobs.

- Total revenues in the Canadian space sector reached $5.6Bln CDN for 2017. This is a slight increase over 2015 ($5.3Bln CDN) and 2016 ($5.5Bln CDN).

- The Canadian space workforce totalled 9,942 space-related full-time equivalents (FTEs), of which 43% were highly qualified personnel (HQP).

- Business Expenditures on R&D (BERD) reached $363Mln CDN, a 43% increase from the previous year.

- Canadian space companies derived $330M in revenues through the commercialization of externally funded R&D projects, a significant growth from 2016.

- Space sector organizations reported a total of 203 inventions and 118 patents.

- Canada's top 30 space organizations accounted for 97% space revenues, 81% of space employment, 88% of BERD, 65% of patents, but only 32% of inventions. In essence, larger companies drove more revenue, hired more people and filed more patents but seemed to invent less.

The complete report is available online from the Government of Canada.

|

| Canadian space companies enjoy a strong reputation on the international marketplace but sell fewer and fewer of their products in Canada. Graphic c/o CSA. |

Recent State of the Canadian Space Sector Reports, as outlined in the December 4th, 2017 post, "The Latest CDN Space Sector Report Notes 5 Year Slump (Except for BC) & Industry Dominates, Not Academia or Gov't," and the July 26th, 2018 post, "Assessing the 2016 State of the Canadian Space Sector Report" have noted an ongoing stagnation of Canadian space industry activities with declining domestic revenues offsetting the growth in sales from international markets.

The latest report continues this trend, although overall growth is now positive. It's likely that the Canadian space industry has finally pulled out of the long-term slump first noted in the 2016 report.

With Ottawa ON based Telesat moving forward with its low-Earth orbit communications constellation and new Federal funding expected to begin flowing to fund Canada's multi-billion dollar "3rd generation Canadarm" contribution to the US led Lunar Gateway beginning next year, it's likely that domestic sales revenue will now begin to increase in parallel with the international market.

_______________________________________________________________________

Henry Stewart is the pseudonym of a Toronto based aerospace writer.

No comments:

Post a Comment