By Chuck Black

|

| Adam Keith. Photo c/o Euroconsult. |

The June 3rd, 2016 release of the Canadian Space Agency (CSA) report on the 2015 "Comprehensive Socio-Economic Impact Assessment of the Canadian Space Sector," originally categorized as "a sweeping study of the benefits of Canada’s involvement in space," seems to have sunk without notice into a summer news cycle more focused around terrorism, consumerism, anecdotal personal interest stories and government PR.

But according to Adam Keith, the managing director of Euroconsult Canada (the firm which compiled the report under CSA contract), there are a number of useful take-aways which could certainly assist with the development of federal economic and innovation policy.

Keith corresponded with the blog last week, with a little help from his colleagues and a little input from the CSA. The questions asked and the answers provided are listed below:

But that was then, and this is now. The current question is perhaps a bit more prosaic. Now that this report has been released, what does the current federal government intend to do with it?

- What are the differences in methodologies between the Euroconsult report and previous CSA reports assessing the Canadian space sector, such as the "2013 State of the Canadian Space Sector Report?"

The objective of the CSA report is to measure, on an annual basis, changes to the baseline features of the Canadian space sector.

|

| Regional distribution of jobs and revenue in the Canadian space sector. Source c/o CSA Annual Survey 2013/ Euroconsult. |

These baseline features take stock of the number of organizations active in the sector and their composition (i.e. the percentage of small, medium enterprises, or SMEs, the share of universities, etc), the sectors of activity (i.e. Earth observation or EO, exploration, science, navigation, satcom and other), the Canadian space workforce and composition (including its share of highly qualified personnel or HQPs, the regional distribution of the workforce and the types of jobs held by the workforce), R&D and innovation, as well as a few other baseline indicators.

The CSA report [i.e CSA's 2013 report] provided data on the sector for 20 years, following a consistent methodology, which enabled comparisons across the years and with other countries. The objective of this current report (the Euroconsult report) is to assess socio-economic impacts of the Canadian space sector.

|

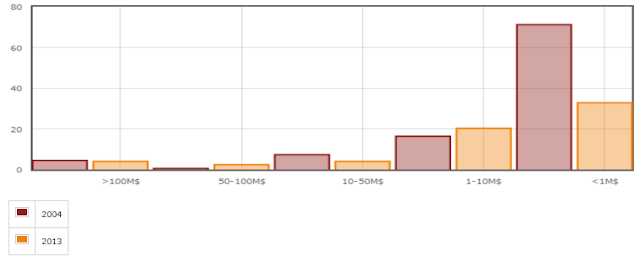

| Chart showing the distribution of companies by revenue in the Canadian space sector. As outlined in the Euroconsult report, "the Canadian space sector is characterized by the presence of a large number of SMEs (firms with under 500 employees) who account for nearly 90% of all organizations. These SMEs are primarily anchored in the engineering & research and services segments." Graphic c/o CSA/ Euroconsult. |

The scope includes the baseline data of the CSA report, and is wider in that it seeks to determine the impacts of that baseline, its social (e.g. connectivity amongst participants in the sector), environmental (e.g. improved natural resource management), strategic (e.g. increased capabilities for DND); and economic impacts (e.g. GDP and stimulation of job creation in the economy)…

The two reports are complementary and do not intend to replace one another.

Editor's Note: As outlined explicitly in the opening "Note to Reader / Upcoming Transition" preface to the 2013 State of the Canadian Space Sector Report, the 2013 CSA report was intended to be the last to use the standard CSA methodologies.

According to the 2013 CSA report, future assessments would use methodologies developed by the Organisation for Economic Co-operation and Development (OECD) which, as noted below, are the methodologies used in several chapters of the more recent Euroconsult report.

It is interesting to note that a review of the graphs and tables contained in the Euroconsult report appear to terminate with 2013 data, as did those in the CSA's 2013 report. Hence, the two documents appear to cover the same time frame.

- How specifically do we directly compare the 2013 State of the Canadian Space Sector Report with section two ("The Canadian Space Sector") and section three ("The Economic Footprint of the Canadian Space Sector") of the Euroconsult report?

The 2013 CSA report coincides very closely with section two of the Euroconsult report (but)... there are two main differences.

|

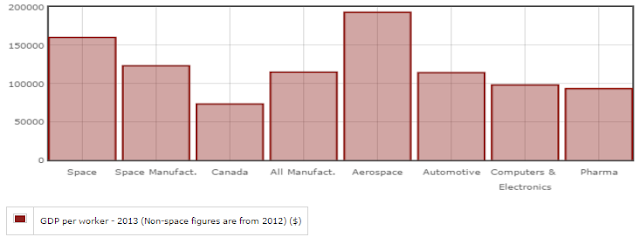

| Labour productivity of the typical Canadian space sector worker as compared to other Canadian industry sectors. According to the Euroconsult report, "with a GDP per worker of roughly $123,000, space manufacturing firms had higher productivity levels than several notable manufacturing sector peers including computers and electronics, pharmaceutical and automotive manufacturing firms. Space manufacturers trailed the productivity levels of the aerospace manufacturing sector, partially attributable to the fact that space firms generally manufacture goods in smaller, less standardized batches than their aerospace peers." Graphic c/o CSA/ Euroconsult. |

First, the CSA data from 1996-2013 had organized revenues into the following categories: Space Research, Space Segment, Ground Segment, Applications and Services.

In collaboration with CSA, Euroconsult reorganized the presentation of this data into categories that align with a value-chain approach: Research, Engineering and Consulting, Space System Manufacturing, Ground System Manufacturing, Satellite Operations, Products and Applications, Services.

This work was in line with new methodologies developed at the Organisation for Economic Co-operation and Development (OECD) Global Forum on Space Economics. Details about these categories can be found in the report.

The second difference is that, since the definitions of the value chain include an expanded view of downstream services, more organizations with broadcasting revenues were included. You will see reference throughout the report to revenues with and without broadcasting included.

|

| A graphic mapping of private sector and government department end users of space based solutions in Canada. According to the Euroconsult report, "there are three different segments to end users of space based solutions in Canada, falling under the categories Communications, Imagery, and Navigation. All of these segments contain private users in Energy/Mining, Forestry, and Maritime; and public users in DFO (the Department of Fisheries and Oceans), EC (Environment Canada), DND (the Department of National Defence), NRCAN (National Resources Canada), and Parks. Communications and Navigation share private users in Telecom, Air, Rail, Road, and Finance; with public users in Telecom. Communications and Imagery share private users in Media and Retail, and public users in Health. Finally, Imagery and Navigation have overlapping private users in Agriculture and Engineering, with public users in AAFC (Agriculture and Agrifoods Canada)." Graphic c/o CSA/ Euroconsult. |

Section three does not have a counterpart in the 2013 CSA report. This section is the core of the economic impact assessment which uses economic modeling to determine impacts on the national GDP and stimulation of jobs created (in addition to those tracked by CSA in the baseline features).

Section three also captures tax benefits to the government. The methodology for this modelling was developed in collaboration with the federal department of Innovation, Science and Economic Development (ISED) and the CSA. A description can be found on page 94 of the Euroconsult report.

- Government space activities as outlined in section two of the Euroconsult report on "The Canadian Space Sector," seem limited to the projects listed on page 17 of the report and include no pure research or R&D functions, except as they relate to the fulfilment of the listed programs. Is this a fair assessment of the current responsibilities of the CSA?

The objective of the report was to assess the Canadian space sector, not to perform an exhaustive review or catalogued audit of the CSA’s activities.

Section two outlines the roles of Canadian government agencies in space, including but not limited to the CSA and is certainly not an assessment of the latter’s responsibilities.

The table specifies in its title that it represents a selection of “major current government space projects”. Impacts of the CSA’s R&D and innovation functions are described in other sections of the report, notably section 3.3.1 the “Support to Innovation” chapter.

|

| The Canadian space manufacturing sector and its connected sectors. According to the Euroconsult report, "For the approximately 10 Tier 1 companies, another 55 companies are estimated to be Tier 2 suppliers and over 200 Tier 3 suppliers, all in all active in well over 20 distinct sectors or industries." Source c/o CSA/ Euroconsult. |

- On page 89 of the report, it states explicitly that "this report does not aim to formulate recommendations." But let's be fair, no government spends $250K CDN without a reasonable expectation that their contracted report will at least collect together some new information useful to the development of policy. What should be the takeaways from the Euroconsult report?

Indeed, providing recommendations was not within the scope of the report. The purpose was to arm the CSA and government policy-makers with a view of the benefits derived from space activities in Canada.

Key takeaways relevant to policy-making are detailed in section five, the “Conclusions” chapter.

A key message/finding derived from the expanded analysis of the sector’s broader economic impacts is that the Canadian space sector, notably within its manufacturing base, is highly productive in terms of its GDP creation per worker as compared to most of Canada’s leading industries.

This is despite the sector’s large number of small and medium enterprises (SMEs), which, as a group, have been historically cited as a reason for Canada’s labor productivity deficit as compared to the United States.

Canada’s space sector also compares favorably in terms of economic (GDP) multipliers (described in the Economic footprint chapter) with the U.K’s space sector, which has benefited from heightened government support in recent years.It's worth noting that this specific type of report might never have seen the light of day and its creators would almost certainly have felt far less comfortable discussing it publicly under the previous government.

But that was then, and this is now. The current question is perhaps a bit more prosaic. Now that this report has been released, what does the current federal government intend to do with it?

Great work, Chuck!

ReplyDeleteExcellent angle. My first thought was how this compared to the 2013 report and you've gone straight to that question.

ReplyDeleteAnother quote I'll make use of is "the Canadian space sector, notably within its manufacturing base, is highly productive in terms of its GDP creation per worker as compared to most of Canada’s leading industries". I'll look up and understand the supporting data you link to, but this certainly reinforces the importance of supporting the Canadian space industry and the relative return on investment it provides compared to other industries.