By Brian Orlotti

As outlined in the April 6th, 2017 Business Insider post, "Goldman Sachs: space-mining for platinum is 'more realistic than perceived,'" the full 98 page report, prepared for Goldman clients by analyst Noah Poponak and his team, argue that recent advances in technology are now making space asteroid mining financially viable, with enormous profit potential.

The report specifically points to falling launch costs made possible by reusable launch vehicles from Hawthorne, CA based SpaceX and Kent, WA based Blue Origin. This is in addition to recent advances in low-cost satellite manufacturing through the use of 3D-printing, commercial-off-the-shelf (COTS) components and open standards.

Marquis US investment firm Goldman Sachs has released a report revealing its bullish outlook on asteroid mining. The report highlights investors’ changing attitudes towards an endeavour that has long suffered from the "giggle factor."

|

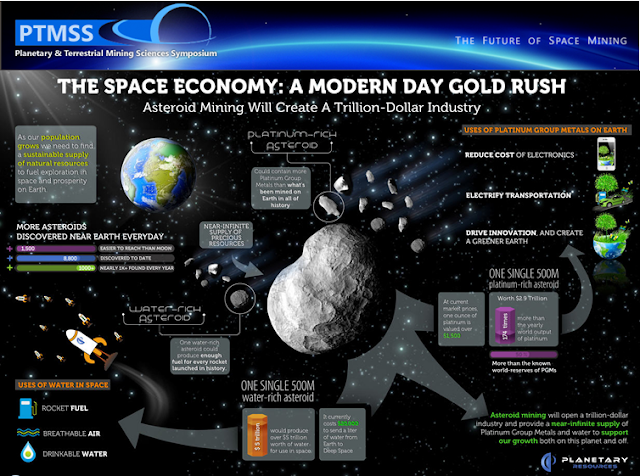

| Rumour has it that most of the major movers and shakers involved with the nascent asteroid mining industry will be attending the 8th Joint Planetary and Terrestrial Mining Sciences Symposium and Space Resources Roundtable, which will be held in conjunction with the annual Canadian Institute of Mining (CIM) 2017 Convention at the Palais des Congres de Montreal in Montreal, Quebec from April 30th - May 2nd, 2017. Commercial Space blog editor Chuck Black will be there to report on the various announcements expected to be made at the event for both the Commercial Space blog and Resource World Magazine. Graphic c/o Deltion Innovations & Planetary Resources. |

As outlined in the April 6th, 2017 Business Insider post, "Goldman Sachs: space-mining for platinum is 'more realistic than perceived,'" the full 98 page report, prepared for Goldman clients by analyst Noah Poponak and his team, argue that recent advances in technology are now making space asteroid mining financially viable, with enormous profit potential.

The report specifically points to falling launch costs made possible by reusable launch vehicles from Hawthorne, CA based SpaceX and Kent, WA based Blue Origin. This is in addition to recent advances in low-cost satellite manufacturing through the use of 3D-printing, commercial-off-the-shelf (COTS) components and open standards.

Another factor making asteroid mining more attractive to investors is the increasing setup cost of Earth-based mines. The Goldman team references a variety of reports, such as the undated Mission 2016 Future of Natural Resources post, "The Process of Mining REEs and other Strategic Elements," to show that from-scratch startup costs for rare earth metal mines are generally upwards of $1Bln USD ($1.33Bln CDN).

Asteroid mining startups like Redmond, WA based Planetary Resources and Mountain View, CA based Deep Space Industries plan to build prospecting spacecraft for tens of millions of dollars and, ultimately, on-asteroid mining and 3D-printing systems in the hundreds of millions or low billions.

These costs are well within the range of both venture capital and traditional investors.

Asteroid mining startups like Redmond, WA based Planetary Resources and Mountain View, CA based Deep Space Industries plan to build prospecting spacecraft for tens of millions of dollars and, ultimately, on-asteroid mining and 3D-printing systems in the hundreds of millions or low billions.

These costs are well within the range of both venture capital and traditional investors.

Goldman considers asteroid mining as a highly disruptive venture, both technologically and economically. Water extracted from asteroids could be easily converted into rocket propellant and stockpiled in low earth orbit (LEO) fueling depots, further cutting the cost of space access. Platinum-group metals (ruthenium, rhodium, palladium, osmium, iridium, and platinum) from asteroids would vastly bolster humanity’s supply of these strategic materials, used in everything from electronics to automobiles to industrial equipment.

The Goldman report even has the honesty to foresee one likely consequence of off-world mining; the meltdown of Earth’s platinum market.

According to MIT’s undated Mission 2016 study, "Mission 2016: Strategic Mineral Management," a single 500-meter-wide asteroid could contain nearly 175 times Earth’s entire output of platinum-group metals.

According to MIT’s undated Mission 2016 study, "Mission 2016: Strategic Mineral Management," a single 500-meter-wide asteroid could contain nearly 175 times Earth’s entire output of platinum-group metals.

With the advent of cost-cutting technologies and the newfound support of capital, space mining is finally poised to fulfill its decades-long promise.

|

| Brian Orlotti. |

______________________________________________________________

Brian Orlotti is a regular contributor to the Commercial Space blog.

That is why we need space farms. http://www.agriengrs.com/others/nasa-eyeing-long-term-space-farming/

ReplyDelete